Augmenting pivot point analysis with candlestick formations helps determine potential turning points in the forex market.

BY JOHN PERSON

Trade setups confirmed by independent techniques or tools — or those that occur simultaneously on different time frames — naturally carry more weight than those signaled by a single input. The trade examples outlined here combine pivot points with candlestick patterns to better pinpoint forex trade opportunities.

Pivot point analysis is based on mathematical calculations used to determine future support and resistance levels. The pivot point value is derived from the high, low and closing prices of the previous price bar, and is then added to and subtracted from the previous bar’s reference points to determine support and resistance levels for future trading. The pivot point (PP) formula is:

1. PP = (H + L + C)/3

2. First resistance level (R1) = (PP*2) - L

3. Second resistance level (R2) = PP + (H - L)

4. First support level (S1) = (PP*2) - H

5. Second support level (S2) = PP - (H - L)

There is some debate about which value should be used for the closing price in the virtually 24-hour forex market. In forex, all trades must be settled within two business days, which is established at the close of banking business at 5 p.m. ET. As a result, this is the time typically used for the closing price.

Using pivot points

Some traders use the pivot numbers to estimate the upcoming high or low, or to simply identify a level at which a market might change direction on an intraday basis.

A popular pivot-point approach is to cover any short positions and go long at either of the two support levels, or sell any long positions and go short at the projected resistance levels. Accordingly, while these price levels provide points at which to enter or exit the market, they also indicate where not to make trades. For example, you should not buy just below either of the resistance levels.

It is beneficial to use multiple time frames — e.g., monthly, weekly, and daily — to identify multiple pivot point support and resistance levels. A particular level has more significance when pivot points on two or more time frames coincide.

Combing pivot point levels with the price moves implied by candlestick patterns improves your odds of identifying favorable trade points.

Candlesticks

The components of a candlestick are derived from the same open, high, low, and close data that make up standard bar charts. The main component we are concerned with here is the relationship between the open and close of a session, which is called the candle’s “body” or “real body.” The color of a candlestick does not indicate whether it closed higher or lower than the preceding candle; rather, it reflects where the candle closed relative to the open.

In Figure 1, the trading period’s high and low are represented by the highest and lowest points of the candlestick, while the session’s open and close are represented by the top and bottom of the wider part of the candlestick. The thin lines at the tops and bottoms are called “shadows” (or wicks), and the wider parts are the real bodies. The candle is typically white (or hollow, or green) if the close was above the open and black (or red) if the close was below the open. Candle A closed higher than the open and candle B closed below the open. Candle C closed above the open — the open was the low price of the day, and the close was the high price of the day. Candle D illustrates the opposite condition. Finally, candle E opened and closed at the same price and is identical to its bar-chart equivalent.

Doji-based patterns: Indecision and reversal

Candlesticks are designed to make bullish and bearish momentum more evident on a price chart. This can highlight certain patterns, such as the high-close doji, that help determine a change in market direction or reversal.

Candlesticks are designed to make bullish and bearish momentum more evident on a price chart. This can highlight certain patterns, such as the high-close doji, that help determine a change in market direction or reversal.

A doji is a candle that opens and closes at (or very near) the same price — look again at Candle E in Figure 1. Such candles indicate indecision or uncertainty. Both buyers and sellers have lost confidence from the time the market opens, as price has pushed both higher and lower, only to end up where it started. Indecision is the last thing you want to see in a trending market. Rejection or failure from a high or low is a sign potential changes in the market are on the horizon.

In a strong downtrend, a market will usually close near its low as highly-capitalized traders hold or add to short positions overnight. If these bigmoney traders are not confident the market will close lower, the market may have the tendency to close back near the open.

Dojis sometimes appear as part of more reliable two- and three-candle formations, such as the morning star pattern, that highlight reversals. The basic morning star is a three-candle, bottom reversal pattern. When the pattern’s middle candle is a doji, it is called a morning doji star, as shown in Figure 2.

The first candle has a long, black real body (a lower close than open); the second candle has a small body that gaps below the first candle’s body. The third candle is a white candle (a higher close than open), and closes above the midpoint of the first candle’s real body. The third candle’s body may sometimes gap higher than the second candle’s body, as is the case in Figure 2.

There are several variations to this textbook description. For example, the initial black candle might have a small real body and the real body of the long white candle might entirely engulf the long dark candle or simply just partially penetrate its real body. The most important thing to notice is what happens after the doji candle. A candle after a doji that closes above the doji’s high confirms a directional change has occurred.

When either a morning doji star or simply a doji develops after a downtrend — especially if it is near an important target, such as a pivot point support level — it is likely if the next candle closes above the doji’s high, a reversal of the recent trend will occur. To trigger an entry, it is important for price to close above the doji’s high. This confirms the breakout and positive momentum should develop within a few bars.

Trade examples: Combining pivots and dojis

Lining up the pivot points on your screen before the beginning of a trading session prepares you for when a setup like a doji or morning doji star pattern develops.

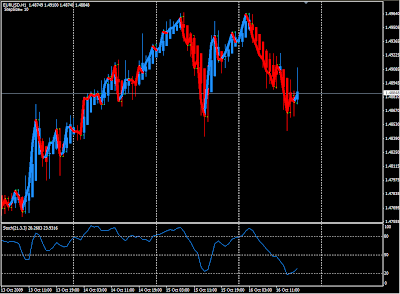

Figure 3 is a 15-minute chart of the Euro/U.S. dollar rate (EUR/USD). On Dec. 10 (a Friday) the high was 1.3318, the low was 1.3148, and the close was 1.3241. The resulting pivot point levels for the following trading day (Dec. 13) are:

Pivot Point = 1.3236

R2 = 1.3406

R1 = 1.3323

S1 = 1.3153

S2 = 1.3066

On Dec. 13 the high turned out to be 1.3325, the low was 1.3192, and the close was 1.3313. The market did not precisely hit the S1 target number, but the low occurred almost exactly at the midpoint (1.3194) of the pivot point (1.3236) and S1 (1.3153). In a bullish market, the market will often hold between the S1 and the pivot point. It is at this price level you should look for setups such as the doji.

Figure 4 is a five-minute chart of the December 2004 EuroFx futures contract (ECZ04) from Nov. 16. Note that once the candle closes above the second doji candle’s high (see the green arrows), price has clearly changed direction.

This chart also provides a good example of how the market reacts near pivot point levels. On the previous day (Nov. 15), the high was 1.2999, the low was 1.2916, and the close was 1.2943. The pivot point was 1.2953 and the support and resistance levels were: R1 = 1.2989; R2 = 1.3036; S1 = 1.2906; and S2 = 1.2870. The high on Nov. 16 was 1.2996, the low was 1.2920, and the market closed at 1.2966.

There were two opportunities to trade from the long side using the doji method. The first doji, which made the low of the day (the first green arrow), was a morning doji star pattern. It formed below the daily pivot point. Notice that once the market closed above the doji’s high it triggered a long position. This up move stalled around the R1 level at 1.2989. (Also notice a doji appeared immediately after the high, and the market proceeded to trade lower.)

Trade management

A risk-control strategy to accompany this pattern might include placing a stop-loss order below the doji’s low by an amount that is 120 percent of the 10-day average range. You could also use a stop-close-only order (which is triggered only on the market close) below the doji’s low for the time period you are trading in.

All time frames

This method is applicable to both the forex market and currency futures, as well as different time frames. (The five-, 15-, 30-, and 60-minute time periods are especially useful in forex trading.) The confluence of trading signals can help identify points at which a market is likely correct or reverse, which is useful for entering trades as well as taking profits.